Alternative Financing for Wholesale

One method is equipment financing/leasing. Tools owners help little and tool dimension services get devices funding and equipment leasing when it is not offered to them with their local area financial institution.

The objective for a supplier of wholesale produce is to discover a leasing company that can assist with every one of their financing requires. Some sponsors look at firms with good credit history while some look at companies with poor credit report. Some financiers look purely at firms with very high revenue (10 million or more). Various other investors concentrate on small ticket transaction with devices expenses below $100,000.

Sponsors can finance devices costing as low as 1000.00 as well as up to 1 million. Services need to seek competitive lease rates as well as shop for equipment credit lines, sale-leasebacks & debt application programs. Seize the day to obtain a lease quote the following time you remain in the marketplace.

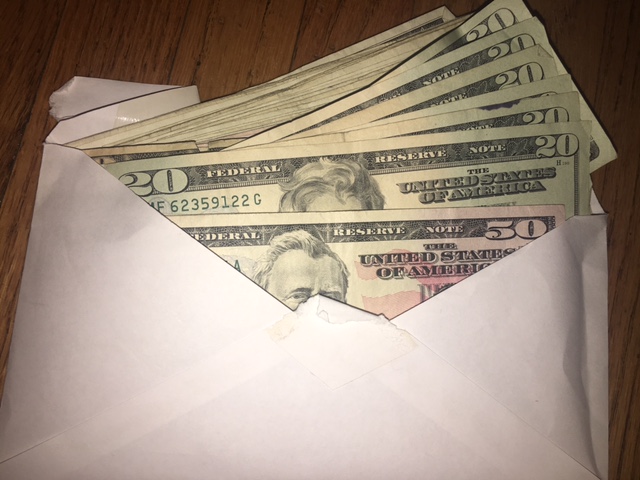

Vendor Cash Advance

It is not extremely typical of wholesale representatives of produce to approve debit or credit report from their merchants although it is an option. However, their sellers need money to buy the fruit and vegetables. Sellers can do seller cash loan to purchase your produce, which will increase your sales.

Factoring/Accounts Receivable Funding & Purchase Order Funding

One point is specific when it comes to factoring or purchase order funding for wholesale representatives of fruit and vegetables: The less complex the deal is the much better since PACA enters into play. Each individual offer is considered on a case-by-case basis.

Is PACA a Trouble? Solution: The procedure needs to be unwinded to the grower.

Aspects as well as P.O. financers do not lend on supply. Let’s assume that a supplier of produce is marketing to a couple local grocery stores. The receivables usually transforms very swiftly since fruit and vegetables is a subject to spoiling item.

Nevertheless, it depends on where the produce supplier is really sourcing. If the sourcing is finished with a larger representative there probably won’t be an issue for accounts receivable funding and/or purchase order financing. If the sourcing is done through the growers straight, the funding has to be done much more very carefully. Get more information on Coastline Credit Union low rate auto loans from this link.

An even much better scenario is when a value-add is included. Instance: Someone is getting eco-friendly, red and yellow bell peppers from a range of growers. They’re packaging these items up and afterwards selling them as packaged products.

In some cases that value included procedure of product packaging it, bulking it and after that offering it will be enough for the element or P.O. financer to look at favorably. The distributor has offered sufficient value-add or transformed the item sufficient where PACA does not necessarily apply.

An additional instance might be a distributor of produce taking the item as well as sufficing up and then packaging it and after that dispersing it. There can be potential right here since the distributor can be marketing the item to big grocery store chains – so to put it simply the debtors can effectively be excellent.

Just how they resource the product will certainly have an influence and also what they perform with the item after they resource it will have an effect. This is the component that the element or P.O. financer will never recognize until they look at the offer and also this is why specific situations are touch as well as go.

You May Also Like

Cool And Great Gifts For Mom

May 14, 2020

New Dental Implant Technologies

June 21, 2019